Who had a sole proprietorship business of trading personal computers. They can be registered with the Suruhanjaya Syarikat Malaysia SSM whether as a sole proprietor or partnership business as doing so will entitle you to some tax incentives that are inaccessible to taxpayers with non-business income.

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Here the liability is undertaken by the.

. A company is tax resident in Malaysia in a basis year normally the financial year if at any time during the basis year the management and control of its affairs are exercised in Malaysia. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. On the other hand SDN BHD comes with limited liabilities.

But during tax computation RM500 will be. Section 138A of the Income Tax Act 1967 ITA provides that Director General is empowered to make a public ruling in relation to the application of any provisions of ITA. RM Gross rental income 100000.

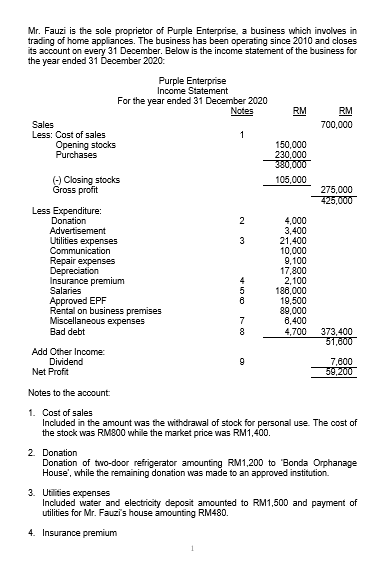

Devis tax computation from rental source for the year of assessment 2010 is as follows. I have a few questions which I hope some of the experts out there can help to answer. Normally those tax not allowable or 50 allowable will be add back when doing tax computation.

To start with first lets calculate Janets income tax payment for YA 2021 if she succeeds in attaining as much as RM 250000 in PBT as a sole proprietor in YA 2021. Generally a company is regarded as resident in Malaysia if at any time during the. Engage chartered accountants or licensed tax agents in preparing business accounts To comply with the Notice of Installment Payment CP500.

It sets out the interpretation of the Director General. This is because of the following laws set in place. Malaysia Corporate Income Tax Calculator for YA 2020 and After.

Sole proprietorship private limited company Deadline for submission of Form B P and payment of tax payable if any. If you earn from rental income Remember To Claim Your Rental Income Tax Exemption iMoney If you earn from trading including crypto trading Active Cryptocurrency Traders Are Required To Declare Their Gains For Income Tax RinggitPlus Note. Audit Assurance and Taxation Services in Malaysia.

Thereby no separate tax return file is neededSole proprietorships in Malaysia are charged the income tax on a gradual scale applied to the individual income from. A business owner and individual who running a business registering business with SSM Enterprise Sole Proprietor and have tax number OG with LHDN. All profits and losses go directly to the business owner.

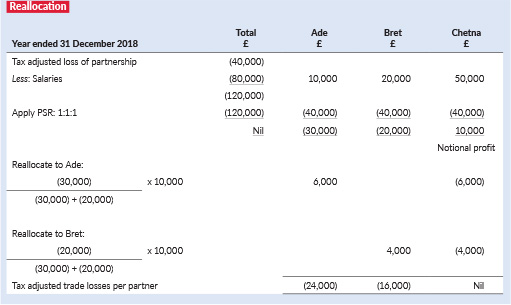

Computation of Partnership Income For tax purposes every partnership would be treated as if it is a sole proprietorship business. I have just embarked on a sole proprietor business in Malaysia. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make.

B He is resident in Malaysia because he is physically present in Malaysia for a period of 182 days or more in 2010. Reliefs YA 2021 MYR. As such the owner receives all profits and makes all executive decisions for the business.

To file Form 941 Employers Quarterly Federal Tax Return or Form 944 Employers Annual Federal Tax Return for the calendar quarter in which they make final wage payments sole proprietors. The gross income and adjusted income of the partnership in respect of each partnership source would be computed as though the partnership was a. Over 18 years of age who is receiving full-time instruction at an establishment of higher education in Malaysia at diploma level and higher or outside Malaysia at degree level and above or serving under article of indentures in a trade or.

72A Jalan Prof Diraja Ungku Aziz 46200 Petaling Jaya Selangor. There are general anti-avoidance rules in Malaysia which allow the tax authority to disregard vary or make any adjustment deemed fit if there is reason to believe that any transaction has the effect of evading avoiding or altering the incidence of. The sole proprietorship in Malaysia is governed by the Registration of Businesses Act 1956.

MALAYSIA wwwhasilgovmy LEMBAGA HASIL DAI-AM NE-GERI MALAYSIA LHDNMR0316. Sole Proprietorship What is a Sole Proprietor business. First comes the liability sector of these two business types.

This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. The Malaysia Tax Calculator can help you calculate Profit Loss accounts deduct all allowable expenses deduct tax relief given by the government prevent you from claim unallowable expenses. Our calculation assumes your salary is the same for and.

On Partnership Firms and LLPs income tax is levied at a flat rate of 30. A sole proprietorship in Malaysia makes no difference between the natural person who owns it and the businessSole proprietorships are pass-through entities. This income tax calculator makes standard assumptions to provide an estimate of the tax you have to pay for.

A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. You do not need to disclose your financial statements to the general public. Since business owners will need to declare all business-related income in their personal tax computation hence the profit loss statement balance sheet statement and all business-related documents and transactions must be kept neatly and organised.

Owner of a sole proprietorship business is liable to all the losses and debts made in the company. A 1 Surcharge would also apply to any financial year of up to 1 Crore. If Janet Remains a Sole Proprietor.

So you can still book RM1000 as entertainment expenses. She will be paying RM 31300 in income tax for YA 2021 and its calculation is. The system is thus based on the taxpayers ability to pay.

1003041 Block J Jaya One No. On 11 October 2019 YB Lim Guan Eng the Minister of Finance unveiled the Malaysian Budget 2020. No corporate tax imposed- As the sole proprietorship is not a separate legal entity from the owner it will not get taxed as such.

An arrangement to sell a partnership firms assets is taxable under Section 112 as capital gains. Profits and Liability. Company secretary or tax agents.

Full ownership- A sole proprietorship is owned 100 by a single person. 20000 in income he shall be liable to pay for this. Spouse under joint assessment 4000.

A person includes an individual sole proprietor partnership corporation Federal. However the profits are all enjoyed by the single owner too. Taxes for Year of Assessment should be filed by 30 April.

Examples of side businesses are plenty including online stores on e-commerce platforms blogging. With our Malaysia corporate income tax calculator you will be able to get quick tax calculation adjustments that help you to estimate and accurately forecast your tax payable amounts. Last reviewed - 14 December 2021.

Tax computation for sole proprietor in Malaysia other additional sources of income. A partnership firm with over Rs. Corporate - Corporate residence.

Below 18 years of age.

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Tax Treatment Of Partnerships Taxation

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Accounting For Partnerships Fa2 Maintaining Financial Records Foundations In Accountancy Students Acca Acca Global

Mr Fauzi Is The Sole Proprietor Of Purple Chegg Com

Malaysia Taxation Junior Diary 9 1 2 Step 3 Draft Tax Computations

A Simple Of Tax Computation Of Partnership In Malaysia Ictsd Org

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Notes Partnership Docx Provisional Adjusted Income Of A Partnership For Ya 20xx Rm Net Profit As Per P L Statement Non Business Non Taxable Course Hero

Format Computation Of Statutory Income For Sole Proprietorship Business For Ya Docx Computation Of Statutory Income For Business Sole Course Hero

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Taxplanning So You Want To Start Your Own Business The Edge Markets

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Acc2054 Malaysian Taxation System Mar 2014 Lecture 8 6 In 1 Contents 1 Badges Of Trade For Unincorporated Entities I E Sole Proprietor Partnership Course Hero